CFOs wear many hats

A Chief Financial Officer has three fundamental tasks: maintaining the books and records of the company, financial reporting, and ensuring statutory compliance. The best CFOs are also strategic partners. This means not only providing financial data and reporting but also advising and supporting actions that will help a company achieve its goals (without breaking the bank).

So why should CFOs care about Superlegal?

When a company has a General Counsel (GC) the CFO and GC work together in the best interest of the company, protecting the company against legal and financial disaster. Together, they identify areas of risk and areas of value, ensuring that legal concerns are communicated and budgets are respected.

But, what if there is no General Counsel?

Many start-ups and mid-size organizations operate as lean as possible. This means that many CFOs find themselves picking up the bits no one else in the company can take on, including legal.

Reviewing routine sales contracts is not the highest and best use of their time. But paying an expensive law firm to review these contracts is not a solution for cost-conscious CFOs.

Superlegal is purpose-built to speed up the contracting process and reduce time to close by up to 73%.

Superlegal is a fast, easy, and cost-effective way to take these contracts off their plate. But our AI-driven approach has additional benefits for CFOs:

- Better monitoring and reporting on contractual risks and compliance.

- Data-driven positions that reflect current market trends & regulatory requirements in real-time.

- Visibility on contractual terms or obligations that may impact the company’s revenue.

- Fewer contract iterations that ease counterparty negotiations and accelerate time to close.

It saves dollars and makes cents

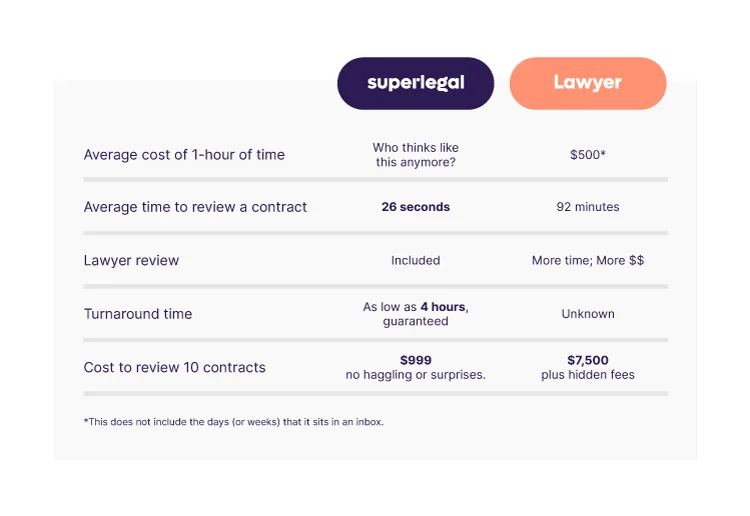

The bottom line falls squarely on the CFO. In most cases, legal fees are unpredictable and expensive – two things CFOs hate. Superlegal’s fixed-fee pricing makes legal fees predictable and reasonable. Let’s do the math:

At the risk of stating the obvious, $7,500 is more than $999. Much more.

Any CFO can appreciate that Superlegal will save the company money. But, will it also lead to a higher value profit for the company?

Yes.

Your company’s success is directly related to how quickly you are able to complete contract review and approval. The longer it takes to finalize the contract the greater the risk of losing the deal because (1) people change, (2) budgets change, and (3) priorities change.

CFOs find themselves picking up the bits no one else in the company can take on, including legal.

Our hybrid process, which uses award-winning AI technology combined with a team of experienced commercial lawyers, is purpose-built to speed up the contracting process and reduce time to close by up to 73%.

Our technology quickly and accurately identifies clauses that require attention which speeds the contracting process. The technology also reviews thousands of contracts daily, giving teams real-time visibility over market trends including changes to pricing and critical terms. This is reflected in our data-driven templates which remove friction in the negotiation process. Data-driven mark-ups suggest legal positions with the highest chance of closing which also speeds up the contracting process.

While our AI contract review technology does the heavy lifting, it is not great at thinking “out of the box” or making compromises. And oftentimes, closing a deal requires both. This is why we keep lawyers in the mix. Our team of experienced commercial lawyers are available 24/7/365 to provide legal advice and negotiate your contracts to close.

By entering your email, you agree to our Terms & Conditions and Privacy Policy.